THR Consulting Group Ltd.

THR Consulting Group Ltd.

Sells, distributes and promotes the books

- Making Your Miles Count: Taxes, Taxes, Taxes

- Making Your Miles Count: Choosing a Trucking Company

Truckers Seminars

Making Your Miles Count Accounting

Provides the following services:

- Full service accounting: (monthly GST, source deductions etc.)

- Truckers only income tax preparation: (personal T1 and corporate T2)

- Truckers comprehensive tax planning

- Government communication and audit assistance

- Trucking company contract consulting and mediation

- Comprehensive administrative consulting to lease/owner-operators

After Tax Meal Calculations

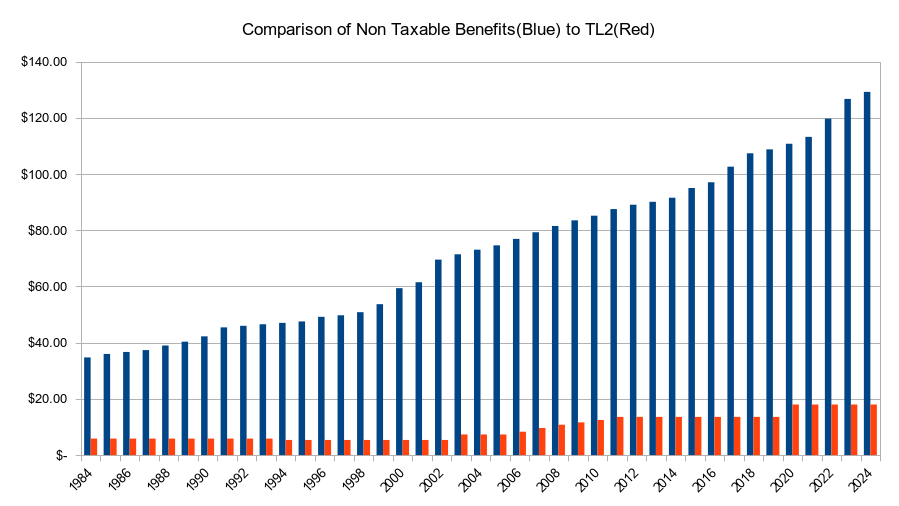

This 36 year chart is an after tax comparison of the two systems discussed in the book “Making Your Miles Count: Taxes, Taxes, Taxes”. The difference consistently becomes larger and larger, year over year because non-taxable benefits increase twice per year at a rate usually greater than inflation. The TL2 simplified method increases only randomly, for example: 2003 ($33.00 to $45.00), 2006 ($45.00 to $51.00), 2007 (start of the increase from 50%-80% deductible) and in 2020 the base increased again from $51.00 to $69.00. The after tax net benefit of $69.00 went to $18.40 (in the best province) up from $13.60.